The open trades page allows you to view all trades that are not yet closed. This is especially useful if you are a long term trader and want to monitor your open positions with your pending profits.

In this article, we will look at how to add an open trade, how to turn an open trade into a closed trade, and how to use your open trade list.

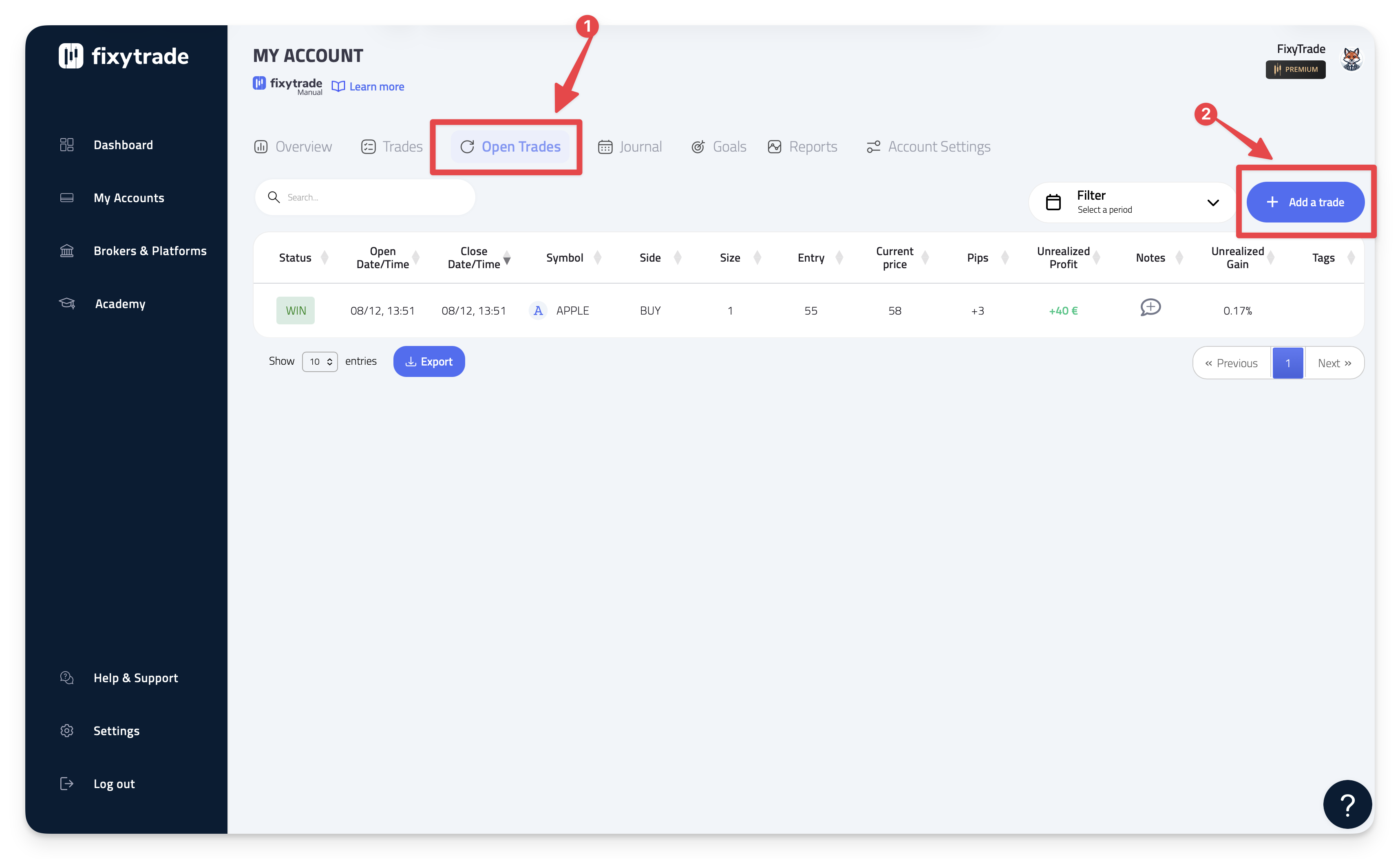

1 - Add an open trade

Adding an open trade is very simple.

-

Click on "Add a trade".

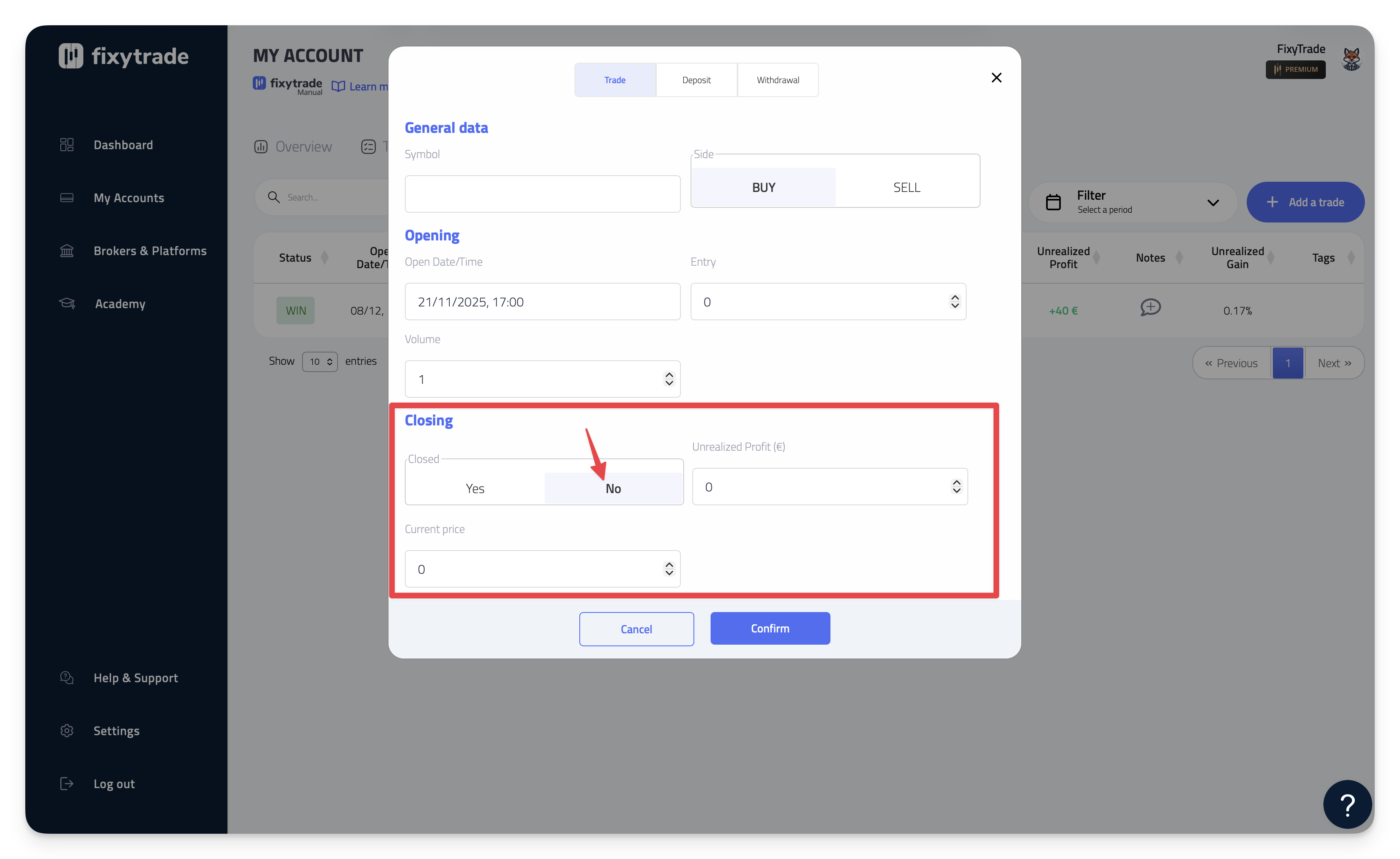

A popup will open. Fill in the different fields as explained in the article on manual accounts (General data + Opening).

-

Under "Closing", click "No" in the "Closed" field and fill in the current price and the current profit.

Click "Confirm" to add the open trade. Your trade will automatically be added to your list of open trades.

2 - Turning an open trade into a closed trade

When your trade will be closed on your trading platform, you will have to transform it into a closed trade in FixyTrade. To do this, follow the steps below:

-

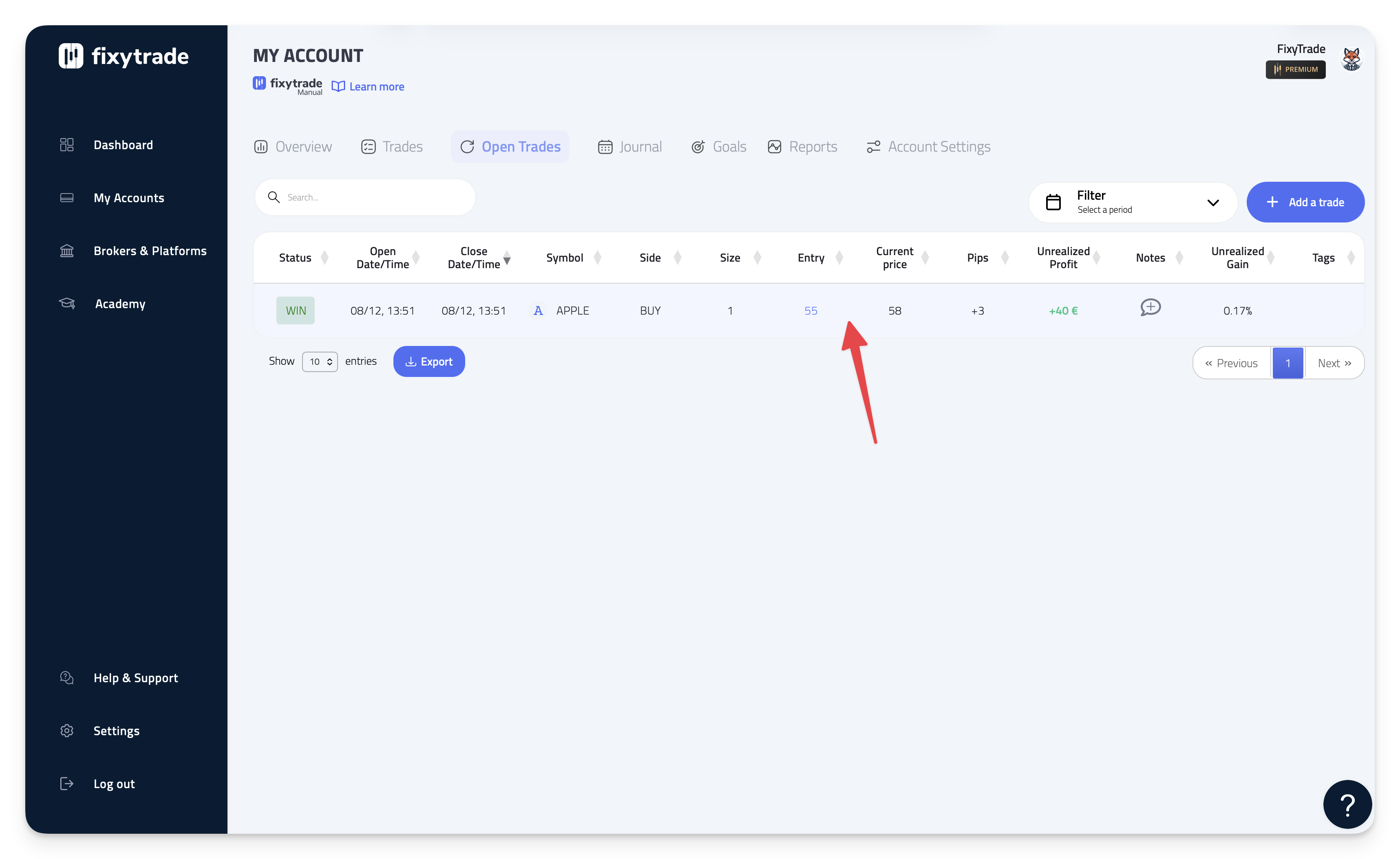

In the open trade page, click on the trade you wish to close.

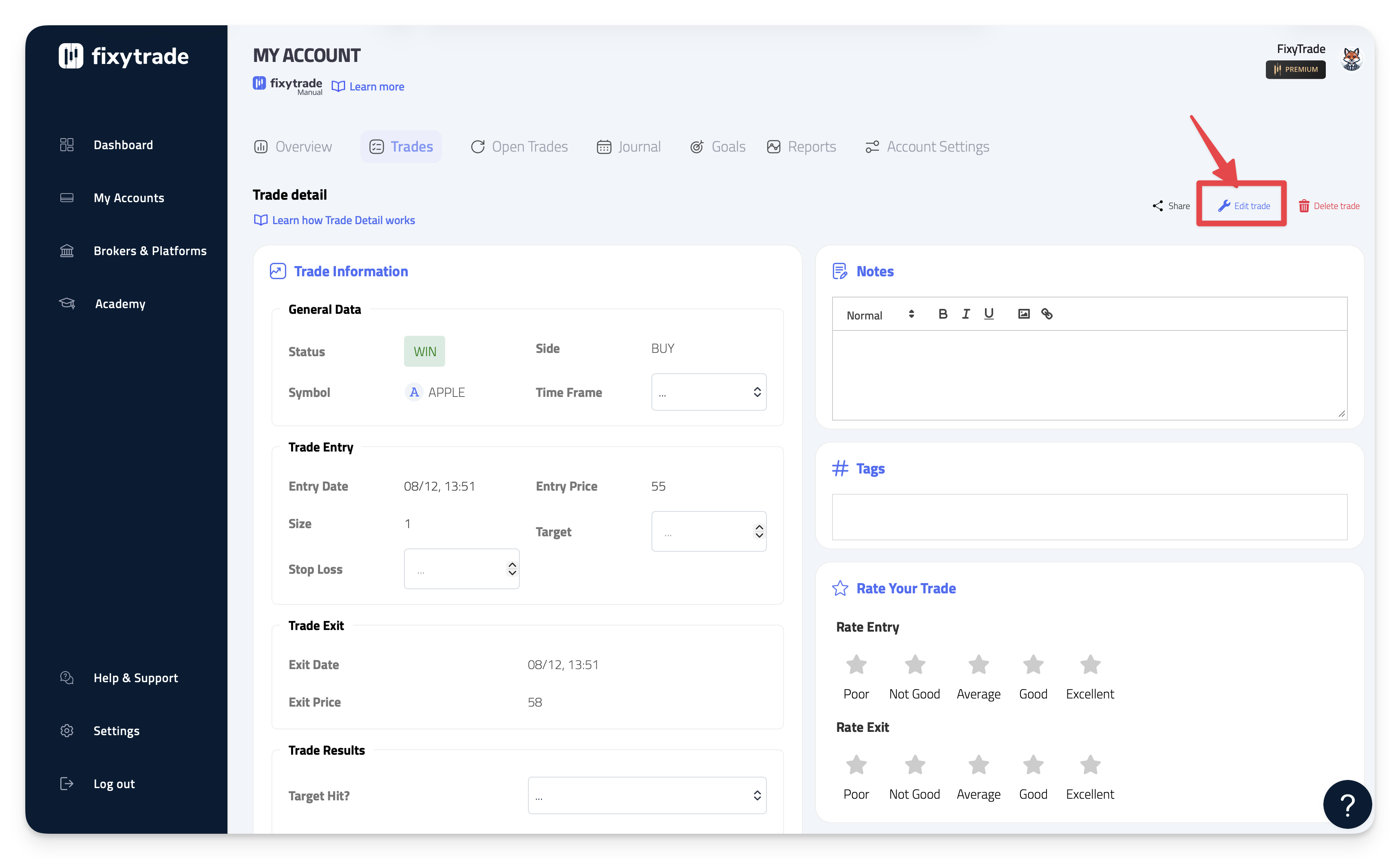

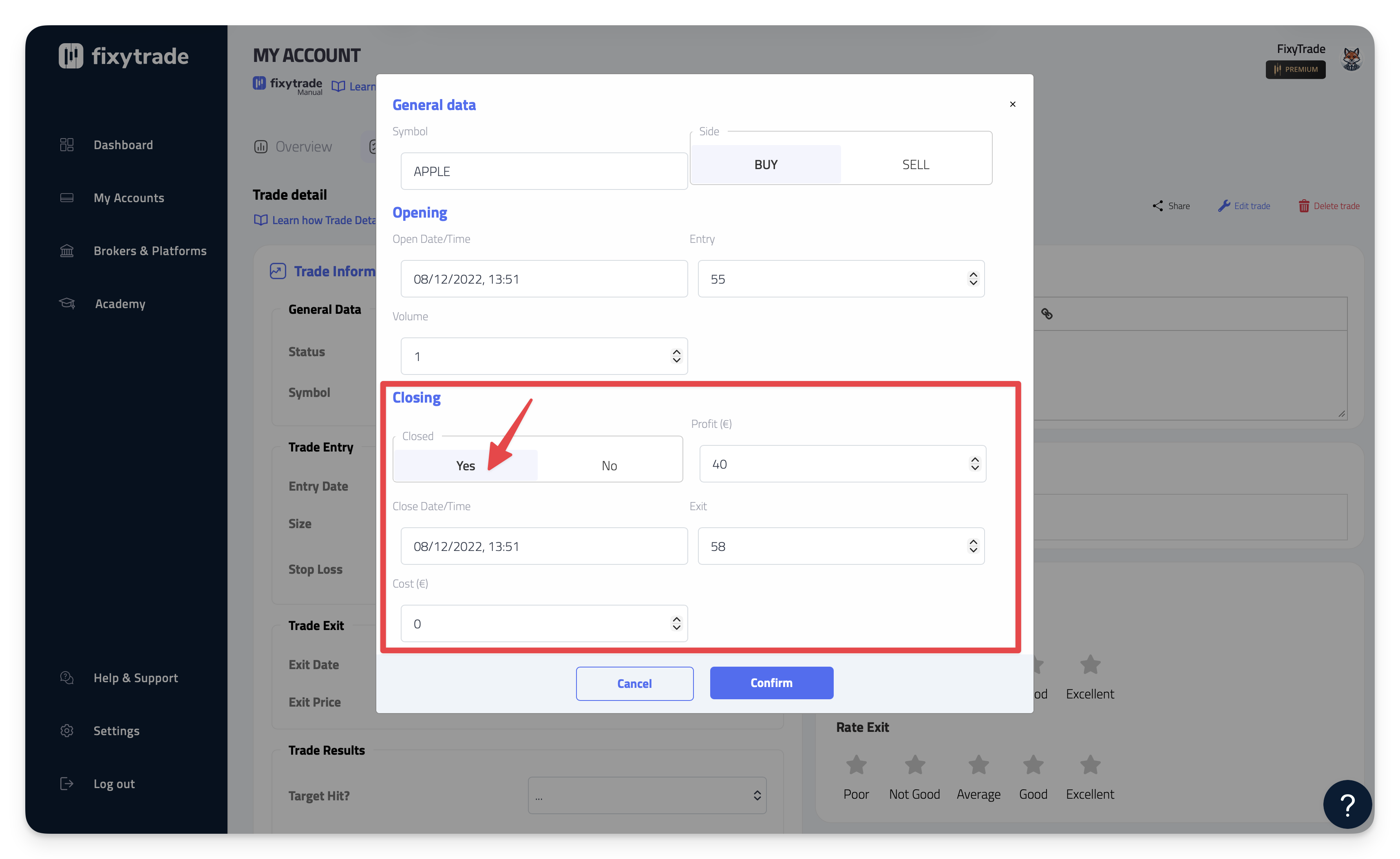

This will take you to the trade details. Click on "Edit trade" to display the trade modification popup.

Under "Closing", click on "Yes" in the "Closed" section. You will then only need to enter your exit price, your profit, and any potential fees for the trade.

Click on the "Confirm" button to confirm your trade modification.

After confirming, your trade will be automatically removed from the open trades page, and it will be displayed in the trades page.

3 - List of your open trades

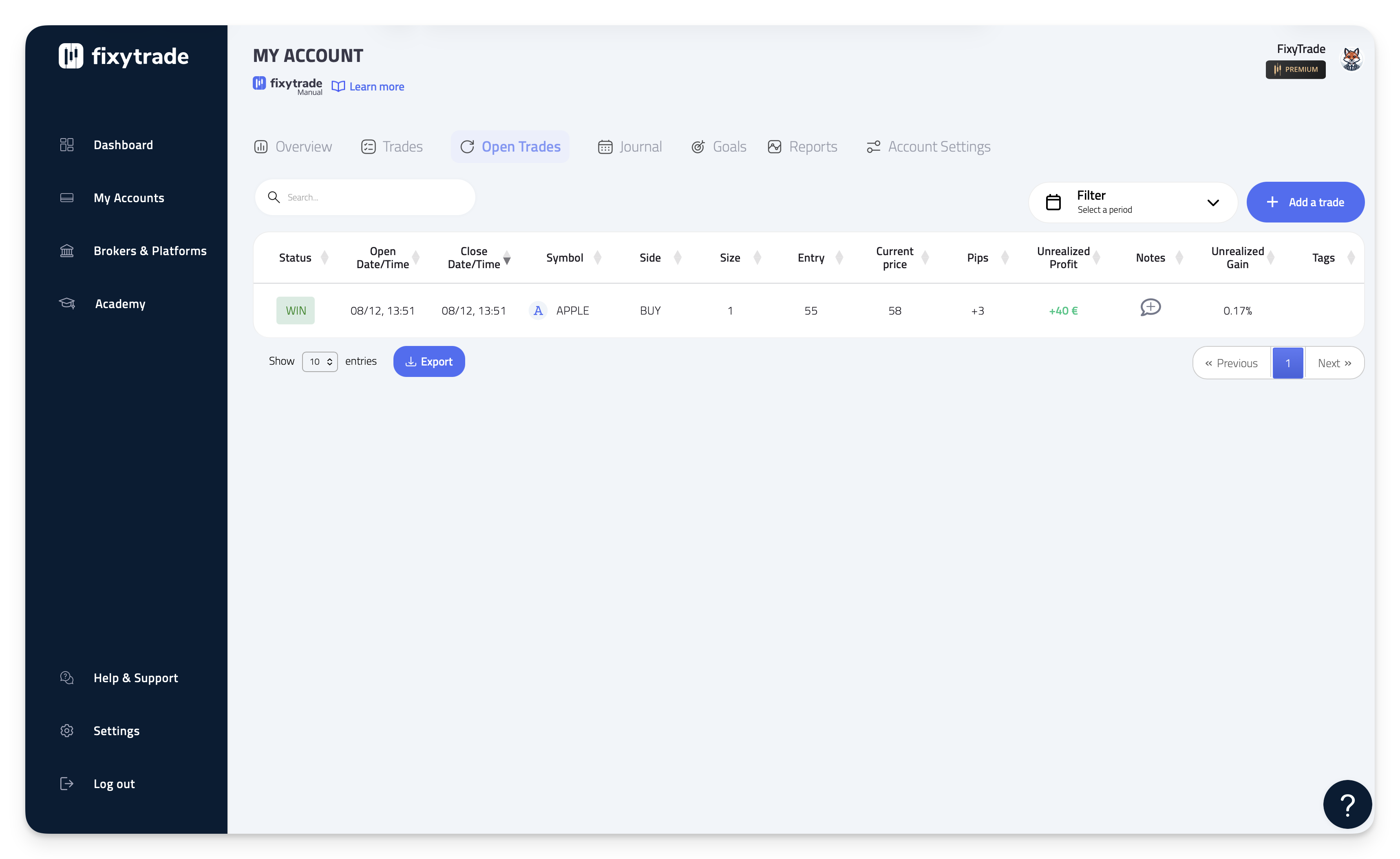

In this table, only the open trades appear. You can find 12 different columns:

-

Status: The status can be displayed in 2 different ways:

-

WIN: The trade has an ongoing profit >0

-

LOSS: The trade has an ongoing loss <=0

-

-

Open Date/Time: This is the time your trade was opened. That is, when you entered the position on the asset. It is also the date and time that a deposit or withdrawal was made. The display format is: DD/MM, MM:HH (Ex: 10/11, 09:24 => The trade was opened on November 10th at 09:24 AM). Learn more

-

Symbol: This is the asset on which the trade was made (Ex: EUR/USD)

-

Side: This is the direction of the trade. Did you open your trade to BUY or SELL. If it says BUY, you were looking to see the price of your asset go up to make a profit. If it says SELL, it is the opposite.

-

Size: This is the size of your position.

-

Entry: This is the price level at the opening date/time of your trade.

-

Current price: This is the current price level of the asset.

-

Pips: This is the difference between your exit level and your entry level. This column is important especially for a day trader, because it allows to understand the dynamics of the trade. Indeed, a trader who will be able to regularly cash in a positive average number of pips will see his trading profits increase naturally and without stress. It is therefore important to focus primarily on achieving goals in Pips and not in Profit. This will allow you to achieve the same results whether you have a small amount of money at the beginning and a large one in the future. Learn more

-

Unrealized Profit: One of the columns that should interest you the most. Indeed, it displays the current money that is won or lost.

-

Notes: By clicking on the "+" icon, it will allow you to access the trade details and add comments and notes on this particular trade. You will also be able to add images (Ex: A screenshot of your trade). Adding notes is a great way to create a history of your trades and how you traded at that time (Benefits: Improved emotional management, Optimized results...) Learn more.

-

Gain: This is the increase or decrease of your account in percentage. For example, if it shows +1.3% on a trade, it means that your account has increased by +1.3% thanks to this trade. If your capital was $10,000 before the trade, it will be $1,030 after the trade. Learn more

-

Tags: Tags allow you to compare your trades or strategies. It's a great way to increase your trading performance to reduce your losses and increase your profits. Learn more

Furthermore, if you click on a particular trade, you will be taken to the trade details. You will be able to modify the trade, close it or add notes, images, tags, and more. Learn more.