The Trading Score will help you to understand where you are in relation to your goal and achieve your goals faster. In short, you will know what to do to improve your performance.

The end result: You’ll reach your goals faster like never before.

In a way that takes your performance… to a whole new level.

EASY TO CALCULATE, FAST RESULTS

We want to show you how to calculate your trading score:

-

that don’t take forever to understand.

-

that don’t make your forehead sweat so bad you instantly regret using them.

-

that don’t make you feel like you don't understand what to change in your strategy.

-

that will help you to focus on the most impactful trades to make better decisions.

If you want to use a Trading Score that help you increase your performance, you have to do it in a way that it's easy for you to use, and ensures that you surface any challenges and goals to reach.

Step #1: Calculate your trading score using the 3 criteria

The first step will be to calculate your trading score using 3 criteria:

-

The % of winning trades

-

The Profit Factor

-

and the consistency of your earnings

You will see that these 3 criteria are very simple calculations that say a lot about your trading.

Winning Trades %

First of all, with the % of winning trades, we want to know if you have a number of winning trades superior to the number of losing trades.

So to calculate it, you divide the number of winning trades by the number of total trades.

In our example, we had 13 winning trades out of 20 total trades. So we have a % of winning trades of 65%.

Profit Factor

Once you have calculated this first criterion, we simply move on to the second criterion which is the profit factor. The Profit Factor is an index of the quality of your trading. It will evaluate the relationship between the risks you have taken and the results you have obtained.

If your trading is good, your profit factor will be higher than 2. A Profit Factor below 2 indicates that the risks you are taking to increase your capital are too high.

To calculate it, you add up all your gains and divide them by all your losses.

For example, here we have 892$ of profits and 278$ of losses, which gives us a good ratio of 3.2.

Learn more about Profit Factor

Consistency

And finally, to calculate your trading score, we're going to look at the consistency of your earnings.

This is the number of weeks in a row. Did you have continuous profits for just one week or for 5 weeks in a row like in our example.

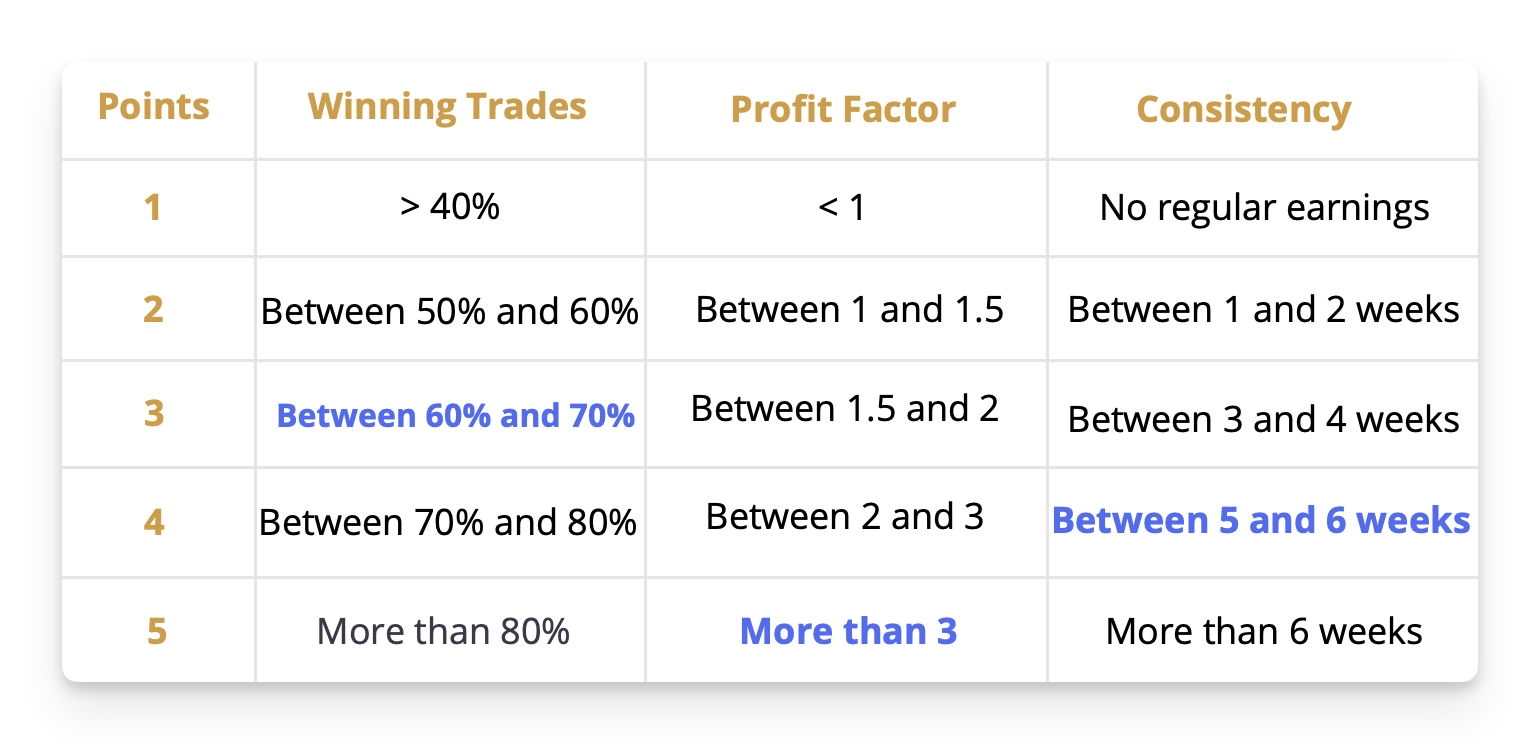

Step #2: Assigning points to each criterion

Then, we will assign points from 1 to 5 to each criterion according to your results.

So, the maximum number of points you can get is 15.

For example, for the winning trades, if you are between 60% and 70% as was the case in our example, then you can give yourself 3 points.

For the profit factor, if your score is between 1 and 1.5 then you can give yourself 2 points.

In our example, we were at 3.2, so we can give ourselves 5 points.

Then finally, you simply look at the number of weeks in a row that you are profitable.

In our example, we were at 5 weeks, so we can award ourselves 4 points.

And then you add up the number of points.

In our example, we got 3 + 5 + 4, which gives us 12 points out of 15.

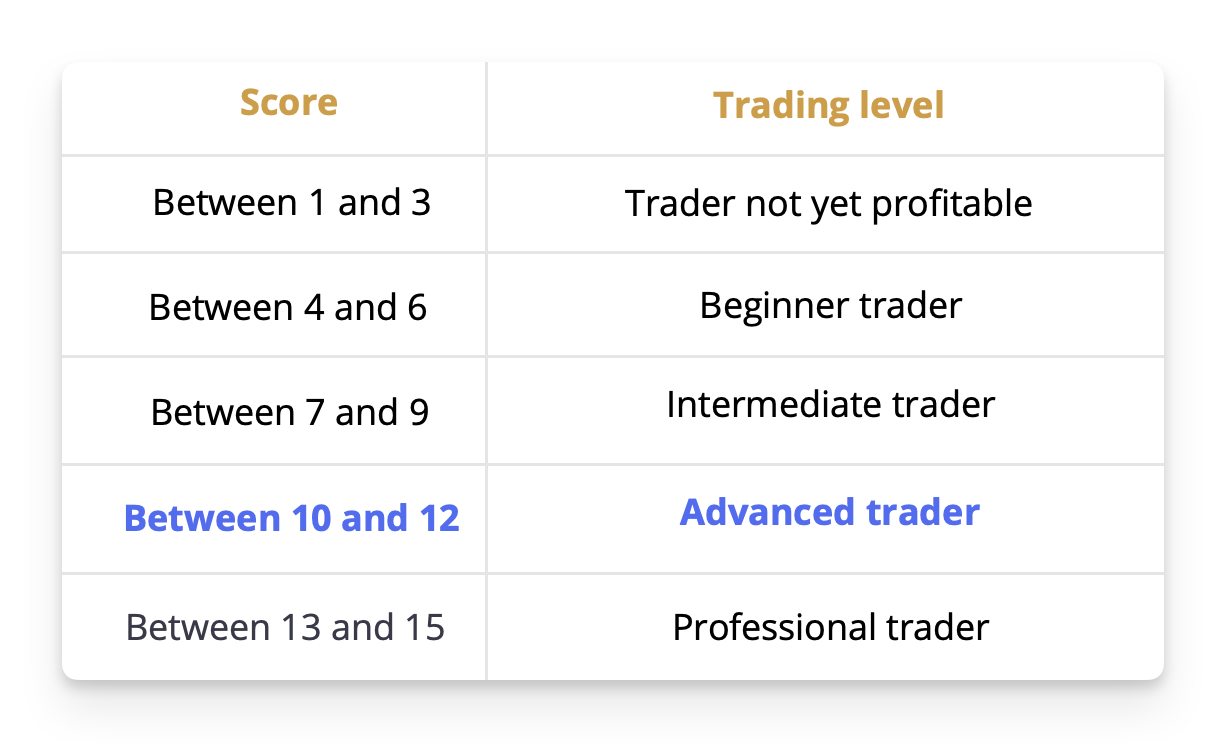

Step #3: Discover your level

We will now discover what this means, and which score corresponds to which level.

Depending on your score, you will get your trading level:

So as we got 12 points in our example, we are an advanced trader.

-

If you have a score between 1 and 3, it means that you are not yet profitable.

-

Between 4 and 6, you are a beginner trader.

-

Between 7 and 9 points, you are an intermediate trader…

As you understood, this trading score aims to help you improve your performance.

So now, challenge you to improve this score by focusing on the 3 criteria, which are the % of winning trades, the profit factor, and the consistency of your earnings.